When the new tax law went into effect, the federal standard deduction doubled. For the vast majority of taxpayers, this eliminates the need to itemize deductions.

That is, unless you use a tax strategy called “bunching.”

What’s “bunching?”

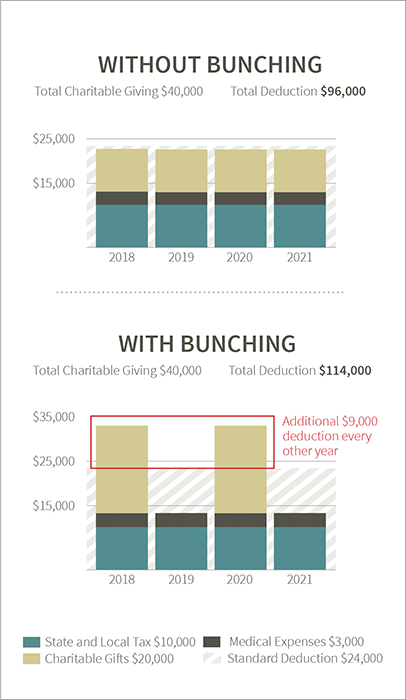

With “bunching,” you make 2-3 years’ worth of charitable contributions in a single tax year. The goal is to exceed the standard deduction that year and itemize instead. Then, during the years you don’t give to charity, you take the standard deduction.

With “bunching,” you make 2-3 years’ worth of charitable contributions in a single tax year. The goal is to exceed the standard deduction that year and itemize instead. Then, during the years you don’t give to charity, you take the standard deduction.

When you “bunch” your giving, your tax savings adds up over time. That’s why many financial advisors now recommend their clients consider “bunching”.

How a donor advised fund makes “bunching” even better

A gift into a donor advised fund is immediately tax deductible, because the fund is managed by a nonprofit.

But you can direct the money to your favorite causes on a time frame that works best for you. This way, charities won’t feel any feast or famine effects from your “bunching” strategy.

As an added bonus, the money in your donor advised fund is invested and grows tax-free, maximizing your giving.

Call the Catholic Community Foundation of Minnesota today to learn more about how to “bunch” your giving with a donor advised fund. Our friendly, expert gift planning officers are ready to answer your questions.

We advise you to seek your own legal, tax, and financial advice in connection with gift and planning matters. The Catholic Community Foundation of Minnesota and its staff do not provide legal, tax, or financial advice.