Charitable Life Insurance

Securing Your Legacy

Life insurance can be an efficient and convenient charitable vehicle for many people. There are a couple of ways to gift your permanent life insurance policy.

How Charitable Life Insurance Works

Transfer Ownership

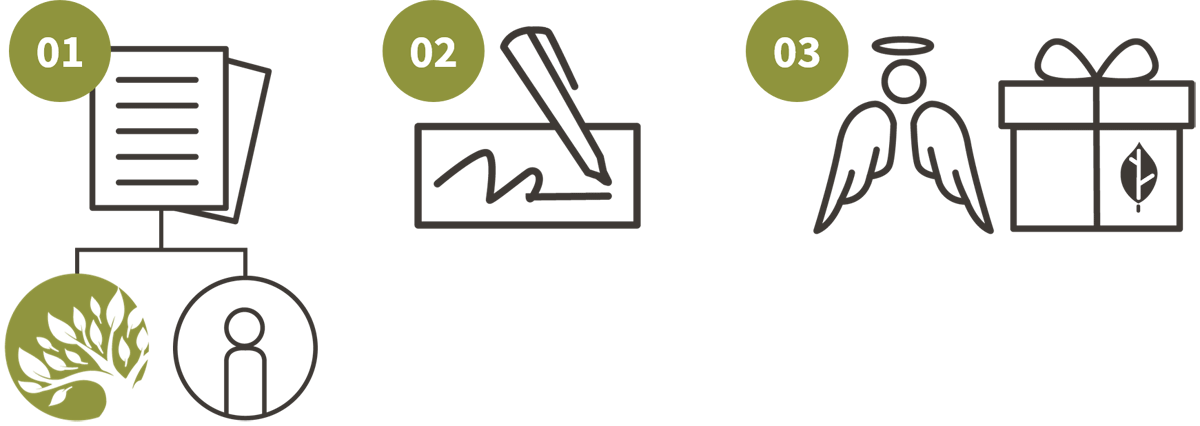

When you (01) transfer the ownership of a life insurance policy to CCF, you receive an immediate tax deduction for the policy’s fair market value, up to 50% of your AGI. If you (02) continue paying premiums on the policy during your lifetime, each payment is tax deductible and the value of your gift increases. (03) Upon your passing, the death benefit establishes your charitable fund, and the gift reduces your taxable estate.

Name CCF as a Benficiary

Alternatively, you can (01) name CCF as a beneficiary to the life insurance policy. You’ll (02) continue to pay premiums as usual. Then, (03) upon your passing, we would receive our designated portion of the death benefit. Some people choose to treat charity as an additional child – so if they have three children, they’ll split the death benefit four ways.

When you name CCF as a beneficiary, you won’t see any tax savings during your lifetime. But this is a great option for folks who are concerned about outliving their savings. It ensures you still have access to the cash value of the policy while planning your charitable legacy.

Ask Your Advisor

How – or whether – you choose to give your life insurance as a charitable gift will depend on your unique situation. Be sure to consult your attorney or financial advisor for advice regarding your specific circumstances.

Get in Touch

We're Happy to Help

Bethel M. Ruest, MBA

Senior Philanthropic Advisor

651-389-0875

Email Bethel

Liz Boo Neuberger, M.A.

Philanthropic Strategist

651-389-0883

Email Liz