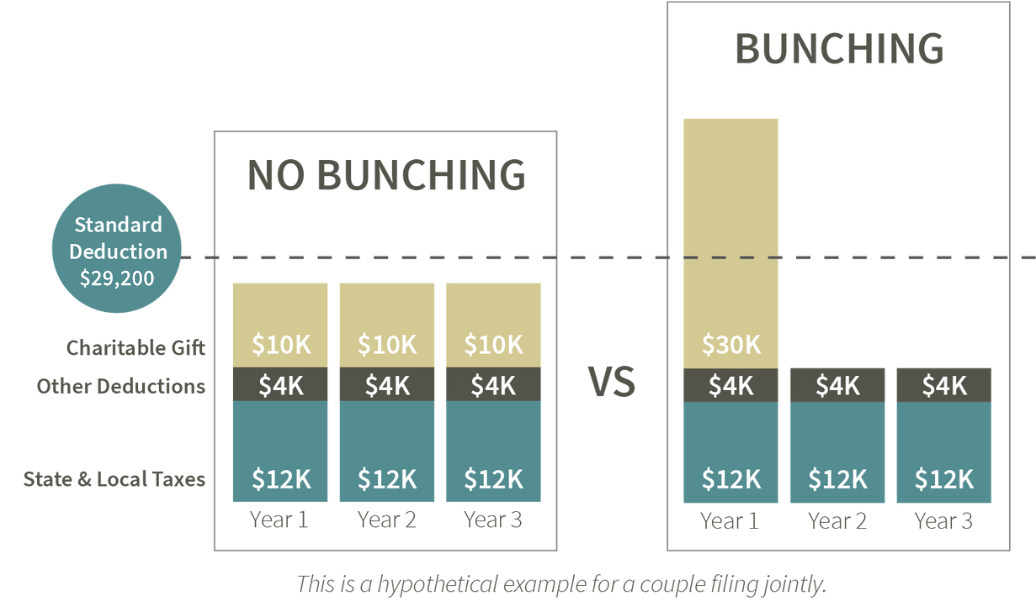

Understanding how to navigate itemized deductions has valuable benefits. With the federal standard deduction at $29,200 for the 2024 tax year, most taxpayers no longer need to itemize — even for charitable contributions. But a strategic approach to charitable giving can make a big difference. It’s called “bunching.”

The Smart Giving Strategy

Bunching helps maximize tax benefits by concentrating 2–3 years’ worth of charitable contributions into a single tax year. This approach allows you to itemize and exceed the standard deduction, enjoying up-front tax savings. In the years you don’t give, you simply take the standard deduction, letting the tax savings add up over time. The strategy is even more effective with a donor advised fund.

Bunch Donations, Boost Your Giving

A donor advised fund (DAF) provides immediate tax deductions, tax-free growth, and a simple way to support multiple charities from one account. By making your bunched gift to a DAF, you can maximize your charitable deductions right away and continue providing consistent support to your favorite charities. You grant from the fund on your own timeline — including during years without giving. Meanwhile, your fund grows through investments. With bunching, your tax savings and smart investments grow your gifts and help you make a bigger impact.

Contact the Catholic Community Foundation of Minnesota today to learn more about how to bunch your giving with a donor advised fund. Our friendly philanthropic advisors are ready to answer your questions.

We advise you to seek your own legal, tax, and financial advice in connection with gift and planning matters. The Catholic Community Foundation of Minnesota and its staff do not provide legal, tax, or financial advice.