‘Tis the season for giving. Whether you surprise your “Advent Angel” or deliver a bag of groceries to a neighbor in need, it feels good to give. That means charitable giving too. But sending gifts to your favorite nonprofits before year-end can create stress when you’ve already got a long to-do list.

‘Tis the season for giving. Whether you surprise your “Advent Angel” or deliver a bag of groceries to a neighbor in need, it feels good to give. That means charitable giving too. But sending gifts to your favorite nonprofits before year-end can create stress when you’ve already got a long to-do list.

Giving should bring you joy, not stress. Yet tax laws pressure you to give by December 31st. This often leads people to give in haste and feel forced to make year-end deadlines.

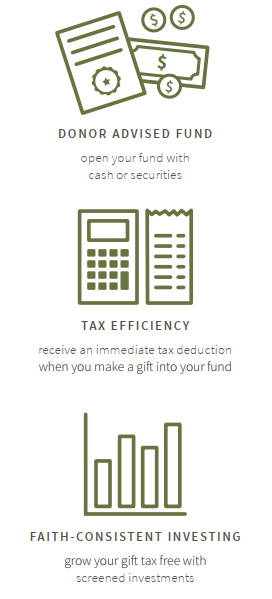

A donor advised fund puts the joy back in giving by removing the pressure of the December 31st deadline. It works like a charitable checkbook.

When you make a gift into your fund, you receive an immediate tax deduction. Then, you decide at your own pace where you’d like to give. While you’re deciding, your fund is invested in alignment with your Catholic faith and grows tax free.

Plus, a donor advised fund makes tax preparation easy. You won’t need to hunt or dig for your charitable giving receipts, because all your gifs are recorded in one easy place online. It’s just one more way that a donor advised fund takes the stress out of giving.

Call the Catholic Community Foundation of Minnesota today to get started. Our friendly, expert gift planning officers are ready to answer your questions.